Prices and Shipping

From Spain to your door

Pricing and Shipping

Pricing

Please email or call for our pricelists. Prices are in Euros - for current exchange rate click here. Our prices are ex-works, or more simply put, the product packed and ready at the factory door.

Containers (Size & Volume)

How much tile or how much ceramic pottery can fit into a 20 foot container? How much in a 40 footer? There are many types of containers - some apt for wood products, others equipped with refrigeration, etc. Each container type has a name. The typical and most used container is called a "dry van" container. Click here to see weight, dimensions and volume capacities of a dry-van 20 and 40 foot container. 10 standard US pallets fit into a 20 foot container and 21 pallets fit into a 40 footer. 11 European pallets fit into a 20 foot container, and 25 fit into a 40 foot container. Since the European pallets are smaller than the US pallets, the actual volume they carry is less. The examples and packing lists below reflect calculations with European pallets.

Packing Lists

For the Stucco Renacimiento packing list, click here. If you want to see an example of how much tile can fit into a 20 foot container, click here.

Click here for a packing list of Le Specialiste de la Terre Cuite, and here for an example container of terracotta.

Currently, we are in the process of compiling a packing list for the ceramic pottery. For information on the size and volume of pallets (American and European) and click here.

Methods of Payment

At Spanish Treasures, we represent and work with several Spanish companies. Each of the companies has their own procedures, policies and methods. Below, we offer "guidance" regarding methods of payment. The idea is facilitate trade, keep it transparent, efficient and mutually beneficial.

- For small purchases (in some cases including samples), we ask for the complete payment via a credit card to cover the products and shipping.

- Our favored method of payment is the Letter of Credit. A letter of credit is a binding document that a buyer requests from his bank that guarantees payment for goods transferred from the seller. A letter of credit assures the seller that he/she will receive the payment for the goods. In order for the payment to occur, the seller has to present the bank with the necessary shipping documents confirming the shipment of goods within a given time frame. It is often used in international trade to eliminate risks such as unfamiliarity with the foreign country, customs, or political instability. In some cases, we can offer a 3% discount for purchasing with a Letter of Credit.

- A third method is a payment of 30% down when the order is placed, with the remaining 70% paid when the cargo is loaded and the container is sealed.

- A fourth method is through an insured purchasing account. In this case, the seller would de provide their business information to a company that insures commercial credit. Once the buying company's credit is checked out and approved, the buyer is given a "line of credit" that is insured. Accounts are invoiced every 30 days.

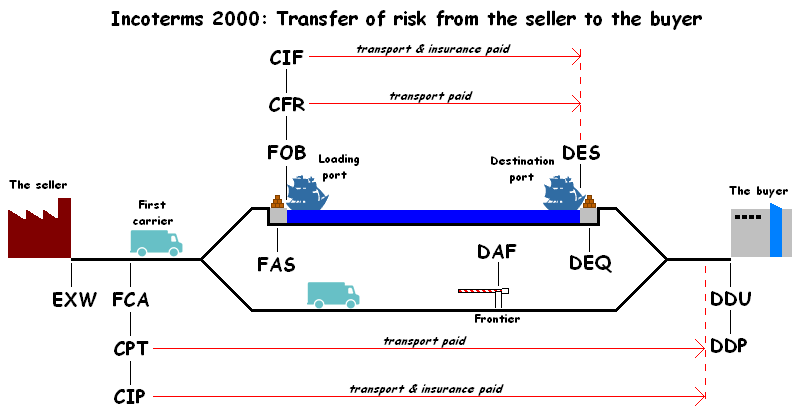

International Transport

Moving goods internationally involves various forms of transport, risk and costs. There are many methods for sharing the risks and costs between the seller and buyer. The actual terms referring to agreements between the seller and buyer are know as Incoterms which help international traders arrive at agreements and clarity regarding costs and risks. Below is a graphic depicting the transfer of goods from the factory to a ship which travels to the destination port where the goods pass through customs and then are shipped to the buyer. The acronyms are the Incoterms (International Commercial Terms) that clarify how the risk and costs are shared between buyer and seller. Also, below please find simply definitions of the Incoterms.

Incoterms

EXW (Ex Works): the seller makes the goods available packed and ready at the factory door.

FCA (Free Carrier): the seller hands over the goods, cleared for export, into the custody of the first carrier (named by the buyer) at the named place. This term is suitable for all modes of transport, including carriage by air, rail, road, and containerised / multi-modal transport.

FAS (Free Alongside Ship): the seller must place the goods alongside the ship at the named port. The seller must clear the goods for export.

FOB (Free On Board): the classic maritime trade term, Free On Board: seller must load the goods on board the ship nominated by the buyer, cost and risk being divided at ship's rail. The seller must clear the goods for export. Maritime transport only.

CFR (Cost and Freight): seller must pay the costs and freight to bring the goods to the port of destination. However, risk is transferred to the buyer (ie insurance responsibilities) once the goods have crossed the ship's rail. Maritime transport only.

CIF (Cost, Insurance and Freight): exactly the same as CFR except that the seller must in addition procure and pay for insurance for the buyer. Maritime transport only.

CPT (Carriage Paid To): the general/containerised/multimodal equivalent of CFR. The seller pays for carriage to the named point of destination, but risk passes when the goods are handed over to the first carrier (ie the buyer insures after the goods are in the custody of the first carrier).

CIP (Carriage and Insurance Paid to): the containerised transport/multimodal equivalent of CIF. Seller pays for carriage and insurance to the named destination point, but risk passes when the goods are handed over to the first carrier. Usually, the seller insures for the minimum amount, leaving a more complete coverage the responsibility of the buyer.

DAF (Delivered At Frontier): Easily understood when the term refers to goods transported by rail and/or road. The seller pays for transportation to the named place of delivery at the frontier. The buyer arranges for customs clearance and pays for transportation from the frontier to his factory. The passing of risk occurs at the frontier.

DES (Delivered Ex Ship): The passing of risk occurs when the ship has arrived at the destination port and the goods are made available for unloading to the buyer. The seller pays the same freight and insurance costs as he would under a CIF arrangement.

DEQ (Delivered Ex Quay): It means the same as DES, but the passing of risk does not occur until the goods have been unloaded at the port of destination (ie unloaded at destination port).

DDU (Delivered Duty Unpaid): Means that the seller delivers the goods to the buyer to the named place of destination in the contract of sale. The goods are not cleared for import or unloaded from any form of transport at the place of destination. The buyer is responsible for the costs and risks for the unloading, duty and any subsequent delivery beyond the place of destination. However, if the buyer wishes the seller to bear cost and risks associated with the import clearance, duty, unloading and subsequent delivery beyond the place of destination, then this all needs to be explicitly agreed upon in the contract of sale. The term is used irrespective of the mode of transport. However when the delivery is to take place at the port of destination, either on board the vessel or on the quay, then the terms DES or DEQ shall be used.

DDP (Delivered Duty Paid): Means the seller pays for all transportation costs and bears all risk until the goods have been delivered and pays the duty.

Customs, Tariffs and Duties

Customs is responsible for assuring international trade flows safely and legally between countries. In many cases, tariffs are levied on international trade to "level the playing field". For more information on the duties levied on Spanish products entering the United States, please consult the International Trade Commission website at http://www.usitc.gov/tata/hts/bychapter/index.htm. For your convenience, a pdf of chapter 69 "Ceramic Products" is available by clicking here.